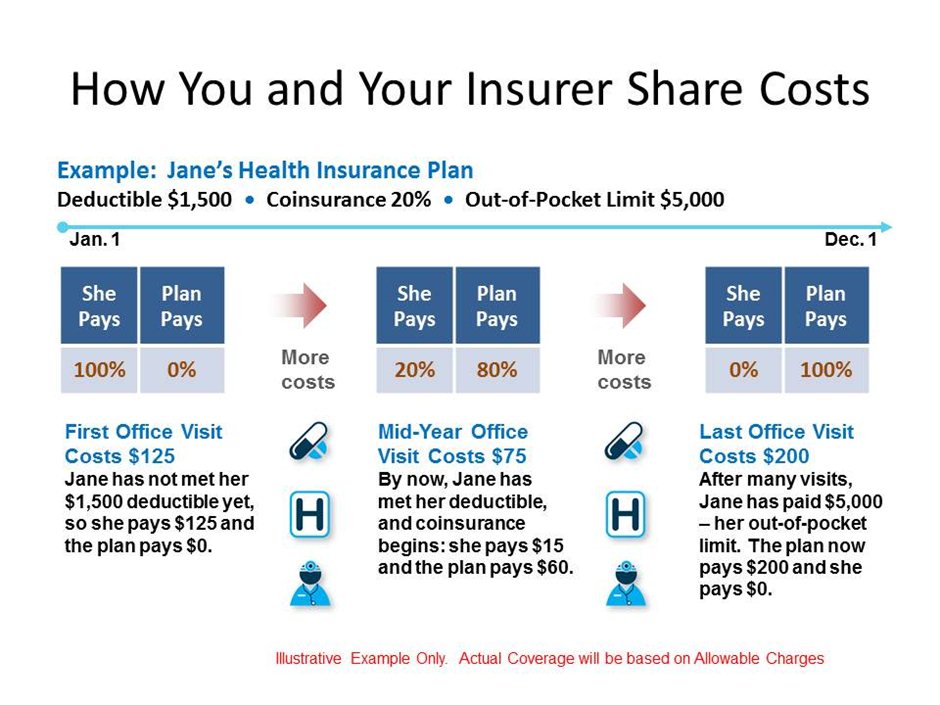

$20 copay 20% after deductible Specialist Office Visit. $45 co pay 20% after deductible Urgent Care. $50 copay 20% after deductible Emergency Room $200 copay (waived if admitted) $200 copay (waived if admitted) Preventive Care. Plan pays 100% - no deductible 20% after deductible. With a 20% coinsurance, you pay 20% of each medical bill and your health insurance will cover 80% after your deductible is met. For example, if your deductible is $2,000, you must pay $100 of your medical bills af. Coinsurance is your share of the costs of a health care service. It's usually figured as a percentage of the amount we allow to be charged for services. You start paying coinsurance after you've paid your plan's deductible. How it works: You’ve paid $1,500 in health care expenses and met your deductible. When you go to the doctor, instead of paying all costs, you and your plan share the cost. The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. Let's say your health insurance plan's allowed amount for an office visit is $100 and your coinsurance is 20%. If you've paid your deductible: You pay 20% of. Deductible First HD01/HD51 $20 copay per visit for primary care and specialist visits after the deductibles met. Prescription medications are available through retail or mail order at a copay range of $10 - $120 after the deductible is met.

As Health Savings Accounts have become quite popular, many people are asking, “What’s the difference between a traditional insurance plan and an HSA-based plan?” Both plans offer valuable insurance coverage to protect you from high-cost medical expenses, and yet there are some key differences. So let’s examine their core distinctions, the advantages and disadvantages, and the cost over time.

On a traditional “co-pay plan” you and your employer pay a monthly premium to cover the cost of your health insurance. Then, when you go to the doctor or pick up a prescription, you pay a fixed cost called a “co-pay” and the insurance company generally covers the rest. Co-pay plans also have a deductible. Once you’ve met your deductible you also have a co-insurance phase with cost-sharing between you and your provider on high-cost medical expenses before you meet your max out-of-pocket. Once you’ve met your max out-of-pocket, insurance will then generally cover the balance. And, most all preventive services are typically covered 100%. Just check with your plan for those details.

A typical co-pay plan look something like this:

- $25 co-pay for an office visit

- $10 co-pay for generic prescription drugs

- $50 co-pay for brand name prescription drugs

Your deductible could be anywhere from $500 to $2,000, but for this example, let’s use $500 for the deductible.

- 80% co-insurance (you pay 20%)

- $3,000 out-of-pocket maximum

To put a number out there, let’s say that you and your employer pay $6,000 a year, or $500 per month for this plan. Keep in mind, this number will vary based on several factors.

Now let’s talk about HSA based plans.

With an HSA based plan, you often pay a lower premium in return for having a higher deductible. The key difference is that an HSA-based plan has two parts: Insurance PLUS a health savings account. Your HSA is a personal tax-free health savings account that can be used to pay for eligible medical expenses. Usage of your HSA funds may also count toward your deductible and coinsurance amounts. And, remember, like any other insurance plan you pay nothing for preventative care like annual check-ups.

Just like a co-pay plan, in an HSA based plan, you would still have a deductible, co-insurance and an out of pocket maximum. Since your deductible is higher in an HSA based plan, you and your employer will save money….le’t say that by moving to a $1,500 deductible, you and your employer now pay $5,000 a year instead of the $6,000 a year in the co-pay plan. If that $1,000 is put into your HSA, your HSA plan could look like this:

- $1,000 tax-free annual contribution into your HSA

- $1,500 deductible

- 80% co-insurance

- $3,000 out-of-pocket maximum

- $400 monthly premium

Let’s consider an example of how these plans actually work side-by-side.

Let’s say you’re changing a lightbulb and take a nasty fall—It happens, and nobody plans on a painful, broken wrist! After a trip to the Emergency Room, surgery and perhaps some physical therapy, you are feeling a bit better.

But you now have a $10,000 medical bill to cover the services.

In a traditional co-pay plan with a deductible of $500, you pay a co-pay for the ER (say $100), then you would need to pay $500 to meet your deductible. Finally, you would need to pay your portion of co-insurance which is 20% of the remaining $9,500 or $1,900. Then the insurance company would pay the rest. In this example, your out-of-pocket cost for this accident would be $2,500.

On the other hand, er…wrist…consider an HSA-based plan with a $1,500 deductible. That means you have to pay $1,500 out of your own pocket before your insurance kicks in.

Yes, $1,500 is a lot of money, but this is where having a health savings account will help you cover the cost of your medical expenses and help reach your deductible. Remember, that you and your employer saved $1,000 a year by going to the HSA based plan. If this money is deposited into your HSA, you have $1,000 a year to pay for medical expenses.

So now, you have $1,000 to help you reach your deductible, and you need $500 to reach your deductible. Like the co-pay plan, you still have co-insurance, so you will need to pay 20% of the remaining $8,500 or $1,700 or a total of $2,200 ($500 to reach your deductible that wasn’t in your HSA, plus the $1,700.)

So when you compare the co-pay plan with the HSA based plan in this example, in the co-pay plan, your out-of-pocket costs would be $2,500, but in the HSA based plan, your out of pocket costs were $2,200.

Remember, your HSA is a health savings account that you can contribute money to and use for medical expenses tax-free and these funds are yours even if you switch jobs. Your HSA spending may apply to your deductible and coinsurance if those expenses are covered by the plan, which in this case, a broken wrist! Your HSA can help you pay for qualified medical expenses like eyeglasses and dental work, but remember, these expenses will not apply to your deductible.

On a traditional co-pay or an HSA-based plan, your worst-case scenario of reaching your out of pocket maximum could be very similar. The big advantage for an HSA based plan is that:

- you paid less money for your health insurance each month,

- that savings is your money, and

- whatever you don’t spend rolls over year after year and is there when you need it.

It’s truly a compelling, game-changing concept.

For some perspective, did you know that in any given year about 70% of people will spend $700 or less on medical care? If you have an HSA based plan, this is good news because, since HSA funds roll over every year, you get to keep whatever you don’t spend, ultimately encouraging smart medical spending.

What Does 20% Coinsurance After Deductible Mean

HSA funds can also be invested for tax-free growth and investment earnings creating a future financial asset as well as a rainy-day fund for medical services. Over time, you could build up substantial savings in your HSA, then, when you turn 65 years old, your HSA acts like a 401(k) and can be used as another retirement account. In summary, the best thing about an HSA based plan is that it gives you a strategy to save up pre-taxed money to pay for large, unexpected medical expenses.

As you can see, over time you could have more money in your HSA than your deductible, which means you would not have to pay out-of-pocket to meet your deductible.

Let’s review:

Both plans:

- Provide valuable insurance coverage

- Cover preventive services at 100%

Co-pay plans:

- Co-pay – pay fixed amount for medical care

- Lower deductible – insurance kicks in quicker

- Higher monthly premiums

HSA-based plans:

- Health Savings Account (HSA) benefit

- Higher deductible

- Lower monthly premiums

- Tax savings

We hope this helps you understand how the two plans work and how an HSA based plan could provide you with a smarter strategy to pay for healthcare in the future.

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

Understanding Medicare Copayments & Coinsurance

Medicare copayments and coinsurance can be broken down by each part of Original Medicare (Part A and Part B). All costs and figures listed below are for 2021.

Medicare Part A

After meeting a deductible of $1,484, Medicare Part A beneficiaries can expect to pay coinsurance for each day of an inpatient stay in a hospital, mental health facility or skilled nursing facility. Even though it's called coinsurance, it operates like a copay.

- For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance

- Days 61 to 90 require a coinsurance of $371 per day

- Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve' days

These lifetime reserve days do not reset after the benefit period ends. Once the 60 lifetime reserve days are exhausted, the patient is then responsible for all costs.

For a stay at a skilled nursing facility, the first 20 days do not require a Medicare copay. From day 21 to day 100, a coinsurance of $185.50 is required for each day. Beyond 100 days, the patient is then responsible for all costs.

Under hospice care, you may be required to make copayments of no more than $5 for drugs and other products related to pain relief and symptom control, as well as a 5% coinsurance payment for respite care.

Under Part A of Medicare, a 20% coinsurance may also apply to durable medical equipment utilized for home health care.

Medicare Part B

Once the Medicare Part B deductible is met, you may be responsible for 20% of the Medicare-approved amount for most covered services. The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare.

Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

Understanding Medicare Deductibles

Medicare Part A and Medicare Part B each have their own deductibles and their own rules for how they function.

Medicare Part A

Difference Between Copay And Deductible

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period.

Medicare Part A benefit periods are based on how long you've been discharged from the hospital. A benefit period begins the day you are admitted to a hospital or skilled nursing facility for an inpatient stay, and it ends once you have been out of the facility for 60 consecutive days. If you were to be readmitted after 60 days of being home, a new benefit period would start, and you would be responsible for meeting the entire deductible again.

Medicare Part B

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services.

Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

Cover your Medicare out-of-pocket costs

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs.

Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles, copayments and coinsurance.

The chart below shows which Medigap plans cover certain Medicare costs including the ones previously discussed.

Click here to view enlarged chartScroll to the right to continue reading the chart

Medicare Supplement Benefits

Part A coinsurance and hospital coverage

Part B coinsurance or copayment

Part A hospice care coinsurance or copayment

First 3 pints of blood

Skilled nursing facility coinsurance

Part A deductible

Part B deductible

Part B excess charges

Foreign travel emergency

| A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | 50% | |||||||

| 80% | 80% | 80% | 80% | 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

+ Read more1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

- Read lessIf you're ready to get help paying for Medicare out-of-pocket costs, you can apply for a Medigap policy today.

Find Medigap plans in your area.

Find a planResource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?